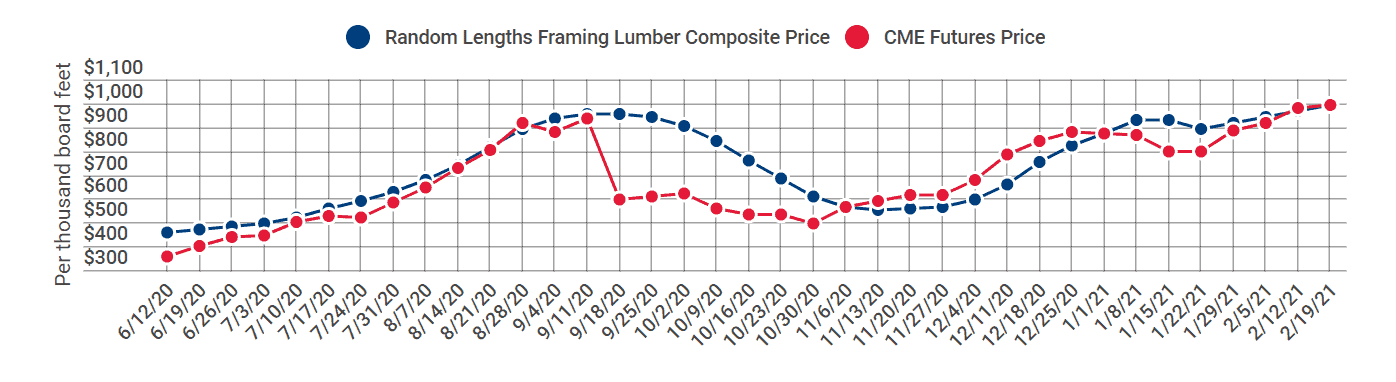

A 180% increase in lumber prices has raised the average cost of building a new single-family home by approximately $24,000 since the spring of 2020.

The above graph shows the overall increase of lumber price over an approximately 9 month period. Rising costs are due to impacts on domestic production and the economic recovery which is being led by the US housing sector. FRAMING AND LUMBER PRICE INDEX FROM NAHB

This significant increase in building materials costs impacts the delicate nature of the housing sector with implications to homebuilders and homeowners, who commit to contracts months in advance of these pricing changes. But there are best practices for construction lenders to proactively navigate markets with rising material costs.

In an ever-changing climate of rising material costs, lenders should pay close attention to the contract between the borrower and homebuilder. The ‘Construction Liability, Risk Management and Building Materials Committee’ of the National Association of Homebuilders published a contract addendum for homebuilders to use in their construction contracts that provides an ‘Escalation Clause for Specified Building Materials’. This document can be used to modify fixed-prices contracts, and, in the event of rising material costs, shift the cost increases onto the homeowner. Lenders across the United States have noticed a significant increase in contracts that include this addendum or one with similar language that has the same impact. These changes to ‘fixed-price’ contracts now act more like ‘cost-plus’ contracts where the homeowner/borrower is assuming the risk of rising materials costs.

For homebuilders, rising material costs threaten their ability to complete the project while maintaining a profit. Additionally, rising material costs cause the homeowner to come out of pocket to cover the difference, which may impact their ability to re-qualify for the permanent mortgage when the construction is finished. Thinly capitalized builders may not be able to, or may not want to, absorb additional costs under ‘fixed-price’ contracts, especially in markets where there is heavy demand and the incentive to simply walk away for more profitable works exists.

Unfortunately, these scenarios are all too real and pose a significant risk to all parties, including the financial institution providing the construction financing. Here are three areas where lenders can leverage sound best practices when dealing with both fixed price and hybrid contracts.

Require Contingency Reserve Accounts

Consider requiring a borrower’s contingency reserve that is financed directly into the loan. The borrower will need to qualify for the increase in the cost to build and the home may need to appraise higher, but the benefit could provide enough cushion to lessen the financial burden on the homeowner should cost increases. The borrower contingency should be kept hidden from the homebuilder and only be used to cover cost overages that the borrower is obligated to pay. Lenders may need to review their construction loan agreement to see if a contingency reserve is contemplated.

Use a Builder Acknowledgement Form

A builder acknowledgement document that is executed prior to the close of the construction loan can help ensure that all parties are on the same page before construction begins. This acknowledgement should clearly address all the covenants that apply to the borrower in their loan agreement, such as the draw and change order process, inspection process, and how cost overages are handled. A good builder acknowledgement form will contain simple language that the builder has to commit to and supersedes any other agreements between the borrower and builder. The benefit of this type of agreement is twofold: first, it provides confirmation that the builder understands the borrowers obligations to the lender, and second, it expedites the contract review process and prevents any hidden covenants that could impact the completion of the project, including rising material cost stipulations.

Review Your Change Order Policy

Review your internal policies and loan agreement to ensure that they include a clause for lender approval of all change orders. Change orders in the construction industry are the process that allows modifications to the construction contract and changes the contractor’s scope of work. Some builders look at change orders to help keep all stakeholders on the same page and prevent surprises when changes by the homeowner result in cost increases. However, some homebuilders use them as an opportunity to sell upgrades and generate additional revenue. Construction lenders’ approach to change orders fall into two categories: those that want to know and those that don’t.

In a climate of rising material costs, not knowing about changes could impact costs and potentially threaten project completion. A construction loan agreement that requires the borrower to provide all change orders to the lender for acceptance prior to making the change allows the lender to review the impact to the collateral before the work starts. Lenders should review their post-closing policies and procedures to see how change orders are currently being managed.

Having an active change order policy allows lenders to exercise caution when reviewing change orders that reduce one line item at the end of the project, such as finishes, pools, or landscaping, at the expense of another to cover current costs. This scenario leads to ‘robbing Peter to pay Paul’, without considering how the reduced line items will be paid for and potentially impact the finished appraised value or the ability to get a successful final inspection by the appraiser.

Change orders for ‘upgrades’ to the budget should be paid out-of-pocket by the borrower to the contractor with proof of payment provided to the lender. Avoid allowing borrowers to use contingency reserves for upgrades until the project is significantly close to complete. During the final draw, the borrower can request any remaining contingency funds be reimbursed or applied to the principal of the loan, depending on the terms of the Promissory Note and Construction Loan Agreement

Rising construction costs impact all parties and a good understanding of the construction loan agreement is essential to the success of a construction lending program. The above practices will help you navigate market trends and implement best practices to reduce risk to all parties involved.

Ready to learn more? Find out what Land Gorilla can do for you, by clicking the button below. Our representatives will help you to get the answers you seek.