Key Takeaways

Surveys and Foundation Endorsements play an important role in construction finance and protect financial institution’s physical interests in real estate. It’s important for construction lenders to fully understand their purpose and benefits when utilizing the tools.

Stay Up To Date With The Latest Land Gorilla News, Blogs, and Resources

Surveys and Foundation Endorsements play an important role in construction finance and protect the financial institution’s physical interests in real estate. It’s important for lenders to fully understand their purpose and benefits when utilizing the tools.

The construction loan agreement is one of the most important legal instruments in construction finance and while these agreements tend to have small variations from the various document providers, they all tend to have similar covenants to cover the physical, financial and legal risk that can be associated with construction finance. Requiring the borrower to provide surveys during the construction process is essential in verifying that the home is being constructed in the correct location and does not encroach on any easements, setbacks, other properties, or violate the rights given to other parties. Because, at the end of the day, nobody wants to move a new structure, or even worse tear it down and start over again.

At their core, surveys are used to establish the property’s location, boundary lines and other issues that can be identified within a property. Lenders can leverage surveys to protect their physical interest by requiring the borrower, by means of their construction loan agreement, to demonstrate that the structure is meeting the covenants of the agreement. More specifically, to demonstrate that the structure is being constructed in the correct location and does not pose risk to the collateral.

An additional option to protecting a lender’s risk is to obtain a foundation endorsement from the title company. This is more common in states like California where surveys are near cost-prohibitive. The foundation endorsement is a cost-effective way to protect the lender’s interest. With a foundation endorsement, the title company will review the location of the forms or foundation to determine if there are any issues and issue an endorsement to the title policy that ensure the lender against loss due to the structure’s location. Some title companies may require that the borrower provide a survey to issue the endorsement.

What is involved With a Survey?

A survey focuses simply on the foundation and possibly the elevation of a structure if it is in a flood zone, providing an effective “snapshot” of the foundation as of a certain date. A surveyor will visit a property to document this critical stage of construction. The survey will plot the location and dimensions relative to property lines, and/or in comparison with previous site plans or plats. Elevation readings may also be taken throughout the foundation to identify any high or low points, serving as a baseline measurement. The results are documented in a report that is certified by the surveyor. It’s important to require that the borrower, builder, lender and title company are intended users of the survey.

How to Obtain a Foundation Endorsement

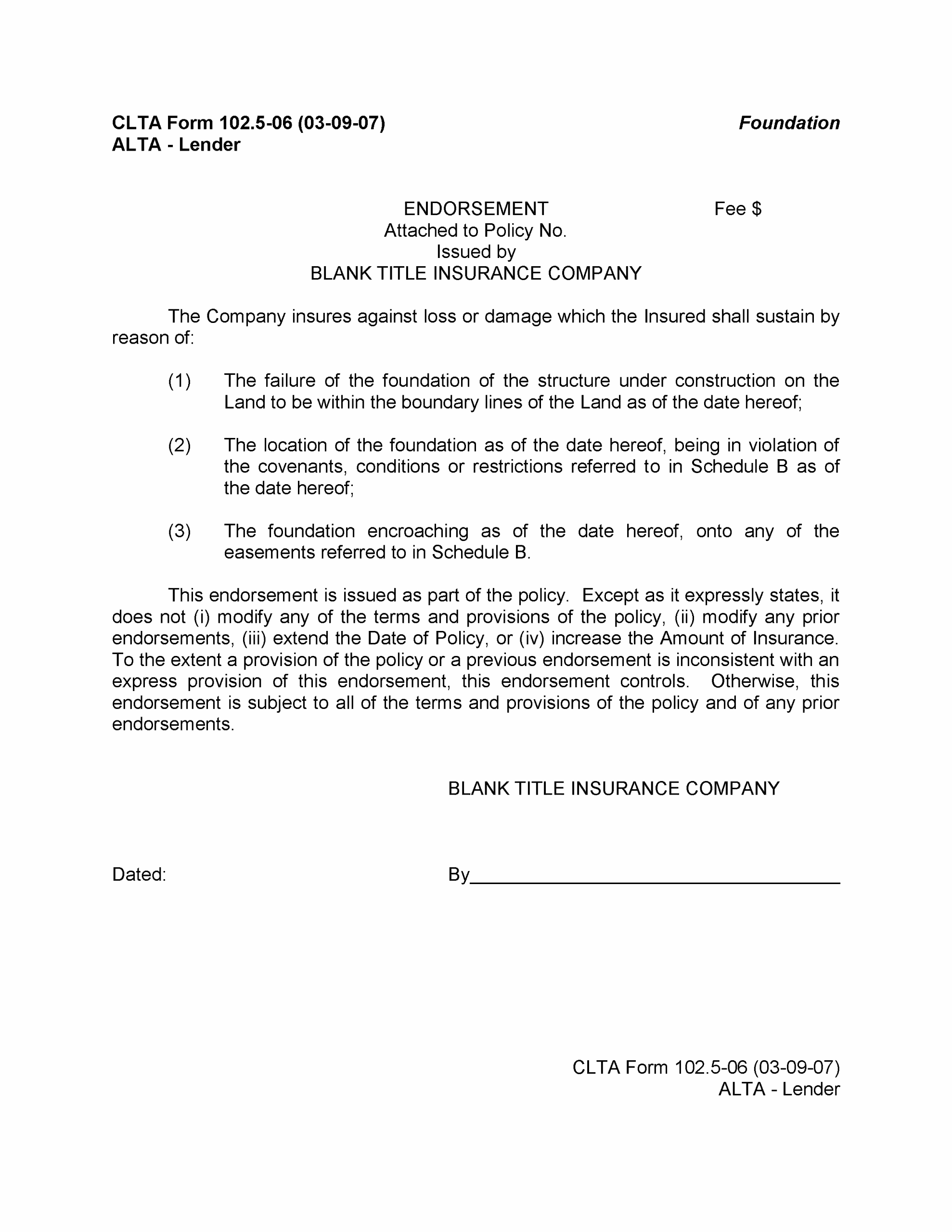

Foundation endorsements are issued by the title company that provided the original title policy. The process starts by contacting the title company and inquiring about what they require to issue the ALTA 102.5 Foundation Endorsement. The form is standardized, however the title company requirements may vary. At the end of the day, it’s up to the underwriter to make the determination of what they require to issue the endorsement.

Once requested, the title company will be responsible for confirming the location of the foundation. They may do this by obtaining their own inspection, sending an employee of the title company to the property, asking the requesting party for the last progress inspection, or requesting a survey from the borrower, owner or builder.

Considerations:

- Foundation Endorsements are more common to requests in California and are generally preferred due to high costs of surveys in the state. Surveys in California tend to be significantly higher in cost in comparison to a foundation endorsement.

- Some title companies may issue the endorsement without a survey while others may require that the builder obtain a survey so they may review it. If you offer the title company a copy of the last progress inspection that shows the foundation location, it’s a possibility that they may not accept it, but if they do accept it then it allows for a faster and less expensive solution.

- As a best practice, it is recommended that this research be done proactively vs reactively; meaning, you should provide the steps necessary to the borrower and builder before they close the loan with a friendly reminder of this obligation before they pour the foundation.

When to Obtain a Foundation Endorsement

Foundation Endorsements should be obtained as early as possible. They may be obtained as early as having the forms set for the foundation, prior to the pour. Having an endorsement at this stage is strategic since any issues can be identified and changes made before the builder commits to pouring a foundation. If issues are found after the foundation is poured, it could be problematic since the foundation may need to be altered or removed entirely. You wouldn’t want to have the home framed and find out that it all needs to be demolished and rebuilt because of an easement issue. Although it is recommended as a best practice that the survey be obtained before the first draw, some builders may simply forget. Do your best to be proactive.

How To Read A Foundation Endorsement

There is a copy of the 102.5 Foundation Endorsement as an example to review. Note the three reasons that the title company is insuring and look for any exemptions that the title company has added. These exemptions are how the title company will notify you of risk and where they will not provide insurance coverage. Sometimes exemptions are found that identify known issues. If you find issues contact the borrower and builder to discuss as soon as possible.

Survey and Foundation Endorsement FAQs

How much do endorsements and surveys cost?

The cost of the foundation endorsement varies from state to state but will be the same cost for any lender. In other words, you don’t need to shop around. The endorsements don’t cost a lot of extra money but if a survey is required to issue this endorsement the cost may be more significant. A foundation endorsement should cost similar to a mechanics lien endorsement while a survey should cost between $250-$700 with the national average at $422 per HomeGuide.com.

Do I collect surveys or foundation endorsements on renovation projects?

Renovation projects typically would not require surveys or foundation endorsements unless the home is adding new square footage in the form of a ‘new addition’.

How do I know which one to collect?

Most states it will be customary to simply obtain and review the survey without needing an endorsement from the title company. In some states like California, a survey is cost-prohibitive and the title company will issue an endorsement and provide any instructions and what will be involved. It’s recommended that the lender obtain a foundation endorsement to have the greatest level of protection.

Who pays for the surveys or foundation endorsement?

The obligation to provide the survey is the responsibility of the borrower, however, the builder could also include this expense in their construction costs if it is agreed to between the parties.

Does the borrower work with Title to request foundation endorsements?

No, foundation endorsements typically require the lender to work with title to facilitate the request since the endorsement is to the lender’s title policy, while the borrower would be obligated to provide a survey to support the request.

Learn more about how Land Gorilla solutions help to make construction financing faster, safer, and more efficient, here.