Traditionally, community banks have dominated the construction lending industry. But many types of financial organizations can benefit from offering a construction loan program. There is a huge market of borrowers looking for construction loans – and if you are an experienced banker, credit union, or mortgage lender who has never offered a construction product, or focused only on renovation loans, it might be time to consider setting up a construction loan program.

7 BENEFITS TO STARTING A CONSTRUCTION LOAN PROGRAM

Starting a construction loan program has many benefits for experienced lenders. Let’s take a look at some of the most compelling reasons why it could help your business.

1. CONSTRUCTION LOAN PRODUCTS ARE A POWERFUL RECRUITING TOOL

Many financial organizations can benefit from offering a construction loan program, especially when it comes to recruiting. One of the best ways to grow your business is by hiring top talent – and studies have shown that one of the key retention and recruiting factors for talent is a competitive pricing model and product growth strategy. Your retail origination teams will value the robust offerings of a construction program and the ability to compete in a market that was previously dominated by community banks. Loan originators want to be in a place where they are doing more business and have more dynamic product offerings to appeal to customers. Don’t lose out on talented originators because you don’t have construction loan products!

2. REFER YOUR CLIENTS “IN-HOUSE” RATHER THAN “DOWN THE STREET”

If you’re already an experienced mortgage lender, it’s highly possible that many of your current clients are clamoring for construction loans in addition to renovation and other types of loans. If your only option is to refer them down the street to another bank, you are losing out on a valuable opportunity. Many borrowers are looking for construction loans – as demonstrated by high demand from originators. If you offer construction loans, you can retain more of your existing customers and capitalize on market share. If customers aren’t getting loans from you, they are asking your originators where to go – so you are essentially losing them directly to your competitors.

3. INCREASED SALES REVENUE WITH PURCHASE MONEY

Don’t rely solely on your refi business! Construction loans are a great way to make purchase transactions to stabilize your sales force during times of fluctuating interest rates – this is typically when refinance business is most volatile. You can stay ahead of the competition by creating your own market with purchase transactions like, new home construction loans and rehab loans.

4. INCREASE YOUR NET INTEREST MARGIN

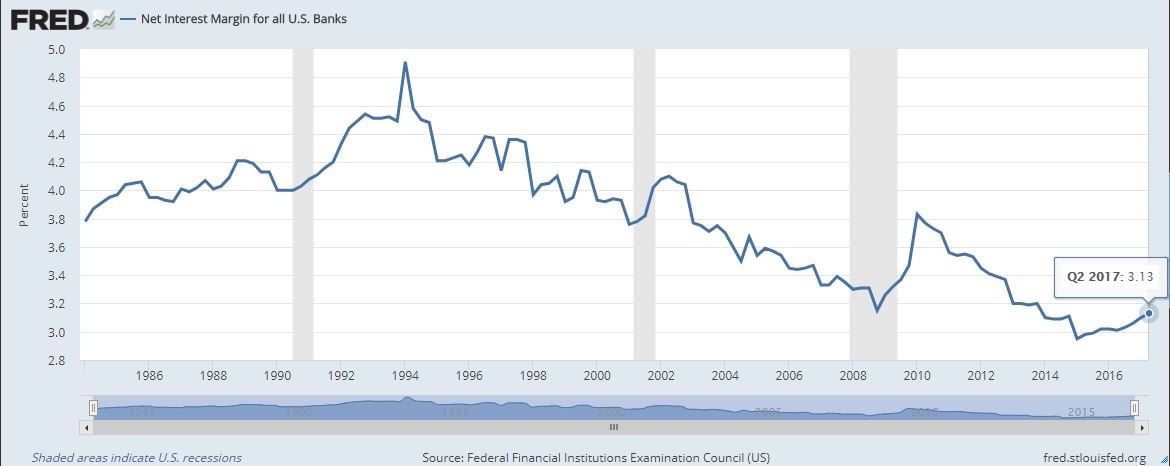

According to FRED Economic Data, the Net Interest Margin for all US Banks (USNIM) in Q2 2017 was only 3.13%. This was actually up 0.12 points from Q2 2016 due, in part, to the recent federal interest rate hikes.

Lending institutions can influence their own net interest margins by diversifying their portfolios with construction and renovation loans.

During the interim construction phase, your term rates are more favorable. Typically, the interim interest rate during the construction period on a CTP loan will be a few points higher than the permanent note rate. Lenders collect the interest rate spread on the loan during the construction period – which gives you a higher margin.

If you are offering a One-Time Close Construction to Permanent Loan, then the interest rate will be fixed for both you and your borrower.

5. ADDITIONAL FEE INCOME

Construction lending is inherently riskier than conventional lending – which means there are higher profit margins. If you opt in to the USDA pilot program, or originate 203k loans and are able to securitize them immediately, the margin you stand to make can be 5 or 6 points.

As a construction lender, you can also benefit from receiving additional income from a fee on the loan. The typical lender may charge a half point or a one point origination fee, which is essentially an extra bonus you get to pocket.

6. COMMUNITY DEVELOPMENT (HOUSING CRISIS)

Don’t underestimate the growing market for property inventory around the country. From 2009 to today, new construction of single-family homes, condos and apartment units reached 5.6 million. During that same period, about 1.7 million housing units were deemed obsolete or uninhabitable and were demolished. There is a true lack of inventory in the U.S. right now. And when that happens, it’s time to create your own market. The nation is facing one of the largest housing shortages since WWII, with low inventory and rising prices driving buyers out of the market. Financial organizations are sitting on a goldmine of opportunity in providing construction loans to new builders. Don’t wait for business to come to your door – get out and create it.

7. FEATURES VS. PRICE

It’s also good to keep in mind that your competitor might be cheaper but not necessarily the best program for the consumer. You have the opportunity to present a product that is exactly right for your customers, even though it might not be as cheap as the loans they can get next door. For example, you can offer a one time close product that eliminates the need for a borrower to re-qualify for a permanent or take-out loan. The borrower knows their permanent interest rate from day one!

USDA recently announced updates to enhance certain features of the existing single family construction-to-permanent financing option. The enhancements allow the lender a new option to immediately pool the loan into a mortgage-backed security to eliminate the need for loan modification or re-amortization after construction.

Solutions like these are game-changers for the housing market and help combat housing issues by making consumer construction lending mainstream.

Want to learn more? Find the construction lending resources you need to enhance your product knowledge.