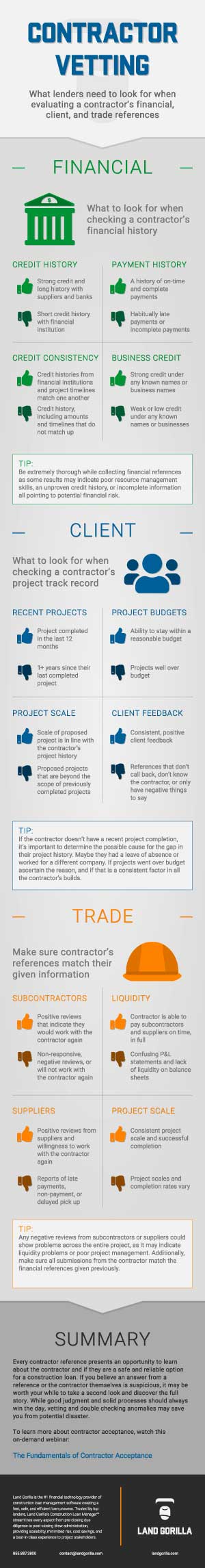

Lenders who offer construction loans know there is a high risk involved in completing a project on time and on budget. Most lenders have a plan to mitigate this risk during their pre-closing due diligence, and one of those things is thoroughly vetting the contractor before a construction loan is closed. This contractor acceptance process includes gathering references and then contacting each reference to verify. Important information to gather is the client’s financial, client, and trade references.

The below infographic contains specific points to gather, and then subsequent warnings or go-aheads based on the results gathered. Find out information about:

- What to look for when checking a contractor’s financial history regarding:

Credit history

Payment history

Credit consistency

Business credit - What to look for when checking a contractor’s client references regarding:

Recent projects

Project budgets

Project scale

Client feedback - What to look for when checking the contractor’s trade references regarding:

Subcontractors

Liquidity

Suppliers

Project scale

Knowing what to look for when gathering the contractor’s references will help expedite the contractor acceptance process and mitigate risk.